Preparing for the Generation Interconnection Process: Key Dates and Best Practices for Interconnection Application Submittal

- cristinaconway

- Nov 12

- 6 min read

By: Sirisha Tanneeru, Lead Engineer, Power Systems Studies and Modeling, Elevate Energy Consulting

As we approach the end of 2025, the generation interconnection cluster study process for the North American grid will officially adopt the annual cluster interconnection process mandated by FERC Order No. 2023, and the Cluster Request Window will be the only opportunity to submit new interconnection applications.

While some ISOs like SPP and MISO anticipate no immediate changes, others are finalizing their transitional periods. PJM, ISO-NE, CAISO, and NYISO are wrapping up transitional cluster study processes and will begin a dedicated Cluster Request Window in 2026. Additionally, most entities in the WECC footprint, which have previously followed a serial interconnection process, will be implementing the cluster study method and will have a dedicated Cluster Request Window.

Cluster Request Window – Key Dates

PJM: Recently announced that Cycle 1 cluster request window will close on April 27, 2026.

SPP: SPP will be implementing Consolidated Planning Process (CPP) for the future cycles. The CPP Tariff was filed with FERC on October 10, 2025, with an effective date of March 1, 2026. The first transition cluster following FERC approval is planned to close on April 1, 2026. The annual cycles thereafter will be open from December 15 – January 15 every year.

MISO: DPP 2025 queue cycle closed on October 7, 2025. Compared to the past queues, MISO has seen a significant slowdown in interconnection requests. While Central and East(ITC) zones have filled up for DPP 2025 and there is overflow into DPP 2026, other regions have seen much lower interconnection applications - especially the south study zone which has seen significant projects in the past has only received 49 applications to date in DPP 2025. East (ITC) 2026 queue cap could already be met.

ISO-NE: Next cluster window will open from October 5 to November 19, 2026.

NYISO: Transition cluster Phase 2 will be studied until mid-2026. NYISO FERC Order No. 2023 compliance filing is not fully approved. The new cluster window date will be announced 30 calendar days after Phase 2 of transitional cluster starts.

CAISO: Cluster 15 is anticipated to conclude on November 12, 2025, and the next cluster will open from April 1-15, 2026.

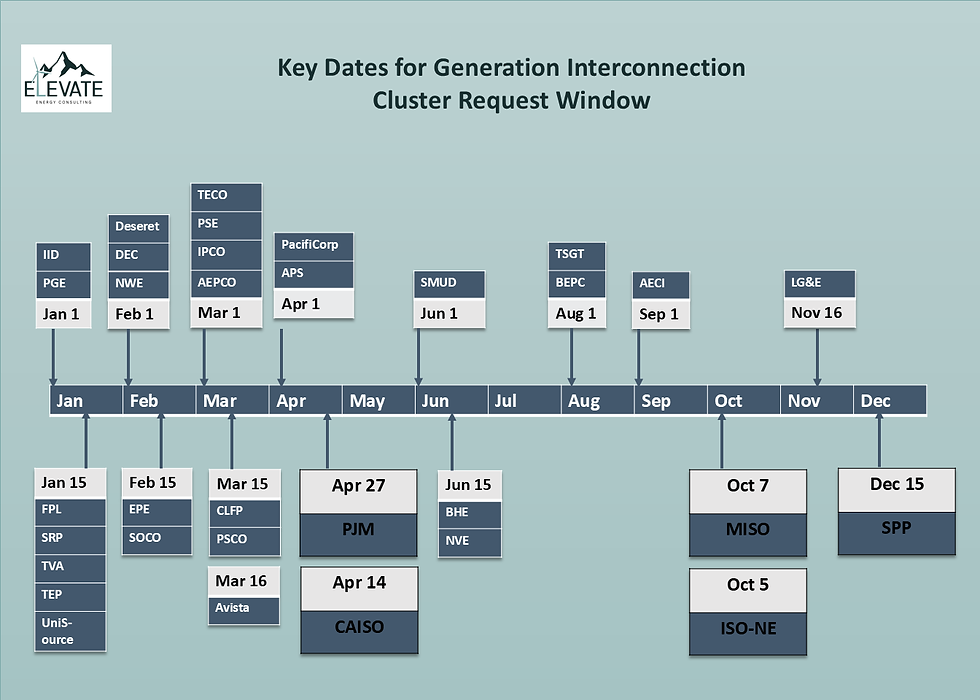

Table 1 below captures the Cluster Request Window start dates of most entities in the North American grid. Each Cluster Request Window is open for 45 calendar days, except SRP and AEPCO which are open for 20 calendar days. AECI Cluster Request Window is 90 calendar days.

Anticipating First Quarter Activity

Going forward, Q1 2026 will become the most active period for interconnection request submissions, with the majority of Cluster Request Windows opening in January and March. Projects will only have 10 business days to cure a deficiency. FERC Order 2023 establishes a variety of requirements to more accurately model non-synchronous (i.e., inverter-based) facilities.

Order 2023 also establishes stricter requirements for modeling non-synchronous facilities, including:

Validated user-defined RMS positive sequence dynamics models

Parameterized generic library RMS positive sequence dynamics models

Validated EMT models, if required by the Transmission Provider

Attestations ensuring the accuracy of model behavior

To this effect, ISOs and TPs are implementing detailed requirements for model submittal and benchmarking of models at the Interconnection Applications stage. Transmission Providers are emphasizing early accuracy in interconnection applications. Frequent issues include (see Slide 51 here):

Inconsistent data across LGIP Appendix, power flow cases, design data, and single line diagrams

Dynamic models failing acceptance and performance criteria

Best Practices for Selecting Inverter Technology at the Application Stage

Common considerations for IBR design and grid code compliance include:

Inverter ratings suitable to meet POI injection limits

Inverters capable of +/-0.95 pf at the POI, with dynamic reactive capability (can be supplemented with shunt reactive compensation, as needed)

Momentary cessation avoided and dynamic reactive current injection is configured appropriately

ROCOF, phase jump, and other protections are not used

IBR plant is designed based on IEEE 2800-2022 standard requirements and practices

Dynamic models are developed, verified, benchmarked, and tested to pass grid code requirements

IBR plant is designed to comply with NERC PRC-028, PRC-029, MOD-026-2, and other incoming Reliability Standards or other ISO/RTO requirements

Importance of Model Verification, Validation, and Benchmarking

While it’s understood that inverter technologies and IBR plant configuration may evolve before a project reaches its Commercial Operation Date (COD), the initial model submitted during interconnection application becomes the reference point for evaluating subsequent modifications. This underscores the importance of submitting reasonably accurate and high quality models that meet the transmission provider and regulatory modeling requirements during the initial application stage.

To meet the new model benchmarking requirements increasingly being adopted by industry, developers should ensure they fully understand the IBR modeling and performance tests used in a specific region as well as the simulation platforms for which these models must be provided. This may include PSS/E or PSLF models, PSCAD models, TSAT models, and other types of models. These models all must be verified to match the as-proposed facility, tested rigorously against the utility/ISO modeling requirements, and submitted according to specific modeling requirements documents.

Conclusion

With Order 2023 reshaping interconnection processes, developers must prepare for compressed timelines, stricter modeling requirements, and heightened scrutiny at the application stage. Early preparation and accurate model benchmarking are now essential for success in the interconnection queue.

Need help submitting interconnection applications and navigating the complex requirements? Contact the Elevate Energy Consulting team of experts (info@elevate.energy), which has deep expertise in IBR modeling – development, verification, validation, benchmarking, and grid code compliance – and has also developed a suite of automations to expedite, streamline, and improve the quality of models provided throughout the interconnection process. Reach out to learn more about how our team can help bring peace of mind throughout the modeling process, help overcome your modeling challenges, and help bring clean energy resources online faster. Let’s start with your applications for the upcoming request windows!

Table 1: Annual Cluster Request Window Start Dates

Acronym | ISO/TP | Cluster Request Window |

AECI | Associated Electric Cooperative, Inc. | September 1 |

AEPCO | Arizona Electric Power Cooperative | March 1 |

APS | Arizona Public Service Company | April 1 |

Avista | Avista Corporation | March 16 |

BEPC | Basin Electric Power Cooperative | August 1 |

BHE | Black Hills Colorado Electric, LLC | June 15 |

CLFP | Cheyenne Light, Fuel and Power Company | March 15 |

Deseret | Deseret Power Electric Cooperative | February 1 |

DEC | Duke Energy Carolinas | February 1 |

EPE | El Paso Electric Company | February 15 |

FPL | Florida Power & Light Company | January 15 |

IPCO | Idaho Power Company | March 1 |

IID | Imperial Irrigation District | |

LG&E | Louisville Gas and Electric Company | November 16 |

NWE | NorthWestern Energy | February 1 |

NVE | Nevada Energy | June 15 |

PacifiCorp | PacifiCorp | April 1 |

PGE | Portland General Electric | January 1 |

PSCO | Public Service Company of Colorado | March 15 |

PSE | Puget Sound Energy, Inc | March 1 |

SMUD | Sacramento Municipal Utility District | June 1 |

SOCO | Southern Company | February 15 |

SRP | Salt River Project | January 15 |

TECO | Tampa Electric Company | March 1 |

TSGT | Tri-State G&T Association | August 1 |

TEP | Tucson Electric Power | January 15 |

TVA | Tennessee Valley Authority | January 15 |

UniSource | UniSource Energy Services | January 15 |

PJM | PJM Interconnection | April 27 |

CAISO | California Independent System Operator | April 15 |

MISO | Midcontinent Independent System Operator | October 7 |

SPP | Southwest Power Pool | December 15 |

ISO-NE | Independent System Operator – New England | October 5 |

AECI – Cluster Request Window open for 90 calendar days.

PJM - Application Deadline of the subsequent Cycle will be announced 180 days prior to the conclusion of prior Cycle’s Phase I Decision Point I. The Cycle 1 post transition cluster will close on April 27, 2026.

MISO - Applications can be submitted anytime. Application cycle close date will be announced by MISO. Application window closes 90 calendar days prior to Phase 1 of that cycle, which follows the Phase 1 completion of the previous cycle.

SPP – Post implementation of the new Tariff, the Annual cycles will be open from December 15 – January 15 every year.

These utilities will be integrated into SPP West in 2026, the interconnection Tariff and any transition plan details are not known at this time - Basin Electric Power Cooperative, Colorado Springs Utilities, Deseret Power Electric Cooperative, the Municipal Energy Agency of Nebraska (MEAN), Platte River Power Authority, Tri-State Generation and Transmission Association, and the Western Area Power Administration (Colorado River Storage Project, Rocky Mountain and Upper Great Plains regions).

CAISO Cluster Request Window will be open for 15 days from April 1 – 15.

SRP and AEPCO Cluster Request Windows are open for 20 Calendar days only.

ISO-NE - Next cluster opens from October 5 - November 19, 2026.

NYISO - Start date announce within thirty (30) Calendar Days of the commencement of the Phase 2 Study of the previous Cluster Study.

PNM - First queue window will open 60 calendar days after the conclusion of the transition cluster study which is currently anticipated to be completed in July 2026. Future clusters will open on the 1yr anniversary of the first queue window.

BPA - Currently studying Transition cluster. Cluster Request Window will be announced 180 CD prior to start date. Window opens ninety (90) Calendar Days after Transmission Provider closes the preceding Cluster Request Window.

Note - Dates are captured from Tariff as of the date of this post. It is highly encouraged to verify updates from TP’s OASIS site before cycle starts.

Comments